Batch EU VAT numbers check

- Firstly, paste your VAT numbers into the form below, one number per line. Currently, you can check up to 10 VAT numbers per request.

- Secondly, launch a validation request by clicking “Check”.

- Finally, the result will be shown below in a few seconds.

Batch check Results

Premium access for Pro users

Get a Premium account to check up to 700 EU VAT numbers per request with no delays!

What is VAT and VIES?

A VAT number or Tax Identification Number (TIN) is a unique identifier for companies, individuals, and entities within the European Union’s Value-Added Taxation scheme

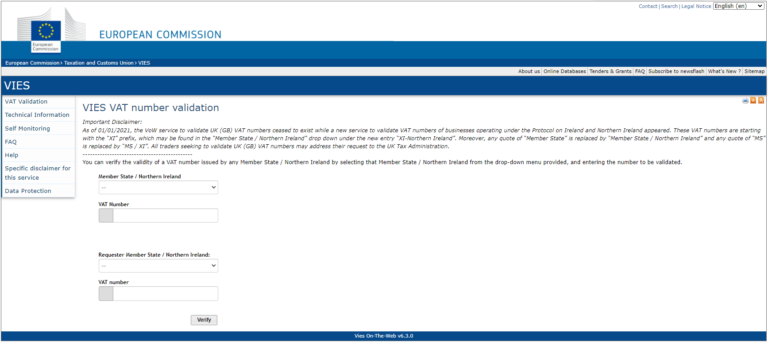

VAT Information Exchange System – abbreviated VIES – is a tool provided by the European Commission that allows you to check the validity of VAT numbers of companies registered in the European Union.

Check the validity of a VAT Number with justaxit and receive results in a few seconds. All information is provided using the original VIES web-service: https://ec.europa.eu/taxation_customs/vies/

Valid response

If VAT number is valid response will be “Valid”.Invalid response

If the system returns an invalid status, reponse will be “Invalid number or EU VIES server is temporarily unavailable. Please check again later”. It means either that the VAT number you are trying to validate is not registered in the relevant national database or these databases are not responding at the current moment for any requests. VAT number can be not registered in the relevant national database due to one of the following reasons:- the VAT number does not exist

- the VAT number has not been activated for intra-EU transactions

- the registration is not yet finalised (some EU countries require a separate registration for intra-EU transactions).

Source: The European Commission VIES-on-the-web

Disclaimer: justaxit.com shall not have any liability concerning the validation result or your use of it.

Please consult VIES FAQ for any questions.

By using our service You hereby agree to use validation results in accordance with VIES disclaimer .